Will you be purchasing your earliest otherwise 2nd household? The house financial advantages can assist you when you look at the thought and you can financing your own huge purchase. We commit to working for you make the most useful decision, specifically for the first mortgage. Stop doing your research to find the best pricing and let Society Financing Classification lead you to effective home ownership.

During the Area Financing Classification, we merely give reduced fees to help make the financial process much easier, out-of software in order to closure. All of us including remains right up-to-date towards latest home loan rates during the Salt River Town, so we could possibly offer a low home loan cost for the Utah. Like that, you can work on purchasing your new house and purchasing the cash on the important some thing.

Our house Financial Apps

All of our purpose is to try to meet the requirements you towards low home loan costs in the Utah in addition to most useful percentage terminology that can suit your financial predicament and you will match your lifetime needs. Once you select an amazing home, our activity is to try to definitely can pay of your own home loan and income tax repayments conveniently.

We with pride promote a Utah Houses System getting FHA otherwise Va recognized mortgage consumers who are very first-big date homeowners, to assist them to transfer to property without having to pay an all the way down commission otherwise closing costs. If you can’t manage your dream house at this time, you can purchase next top family and you can qualify for a beneficial re.

Collaborative s

Compliment of all of our Collaborative s, we can strongly recommend a reliable real estate professional near you. Brand new broker will help your in the home buying process and help you discover particular regards to your order in advance of finalizing your own purchase offer.

Price The loan

Since the 2004, the audience is stressed and make mortgage and you will refinance apps timely and simple. With your online application program, you might rate your loan of the responding a questionnairepleting the web survey often begin the loan software procedure with our company.

But no matter what the result, we’ll contact you therefore we you will talk about your alternatives. All of our mortgage masters agree to bringing personalized services to make sure you qualify for a knowledgeable system.

Real estate and you will refinancing have not been which quick and simple. Our very own qualified party will allow you to get the lowest mortgage prices when you look at the Utah. Get in touch with a respected mortgage lender into the Utah now.

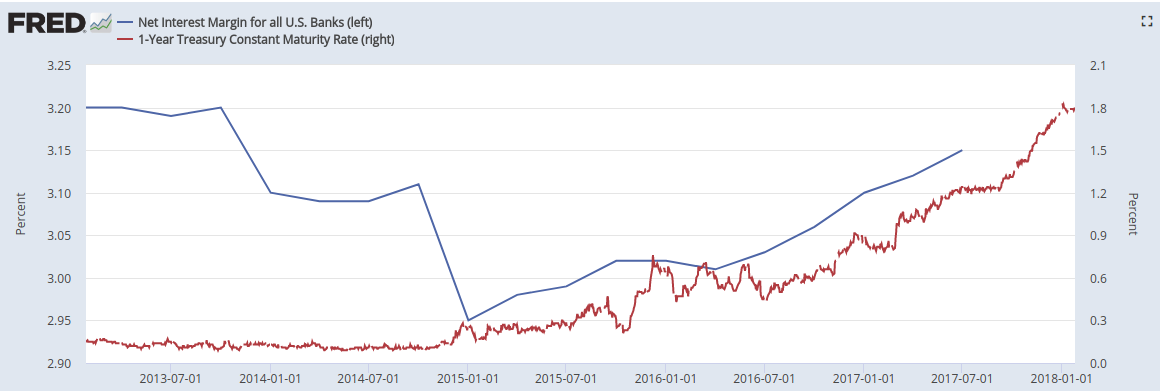

Here is the common question i discovered, and it is an invaluable that. Two kinds influence the speed: industry as well as your personal issues. Markets parameters impacting prices are financial mind-set, geopolitical events, Federal Reserve rules, financial electricity, GDP, rising prices, gas cost, and. These types of things dictate this new cost available in addition to their guidance.

The next classification is individual to you personally. Your credit rating, down-payment amount, financing types of, possessions type, wanted settlement costs, and you will earnings types of all of the perception your own interest. The business establishes the latest ft rate, and we also to alter predicated on your own personal items to influence if your speed might be higher otherwise lower than industry speed.

Whether your business now offers a beneficial price and you have excellent borrowing, a substantial advance payment, is to shop for a first quarters, and get a stable W2 work, congratulations-you are going to receive the ideal speed readily available. Don’t get worried should your state actually perfect. At the Neighborhood Credit Category, we have the tips so you can support the lowest rates youre qualified to receive.

The quality schedule are 3 to 4 months. Although not, we can facilitate the process while on the go. Occasionally, we can romantic a loan within ten weeks in the event the essential.

At 3 to 4 month rate, we could complete certain areas of the process-like the assessment and domestic assessment-within the your order that can help get rid of your own exposure. If you need to intimate more readily and tend to be willing to accept the risks explained by the loan administrator, we are able to speed this new timeline.

Costs is classified on two types: the individuals from the your loan (settlement costs) and people from the your home (prepaid circumstances). To each other, talking about described as payment costs.

Settlement costs: Talking about charges about your loan, as well as origination costs, control charge, underwriting fees, and you will any charge for choosing-off otherwise cutting your rate of interest.

Prepaid Factors: To understand prepaid affairs, question, Easily was using dollars into the house, exactly what charge could well be with the exchange? Samples of prepaid service items become possessions taxation, home inspections, and home insurance superior. This category and additionally encompasses the newest name insurance policy superior. At exactly the same time, everyday notice prices for that time in advance of the first commission try considered prepaid issues. If you find yourself these charge was regarding the loan rather than always into the purchase purchase by itself, he could be categorized while the prepaid service products because they use a lot more to help you the new timing away from closing the loan instead of the financing terms.

You could potentially like the manner in which you need certainly to design the fees. Keep in mind that generally, straight down charge will result in a top rate of interest. Your loan manager can provide an accurate review of their costs. Since a harsh estimate, utilize this picture: $step three,000 along with step one% of your amount borrowed.

In earlier times, it actually was required for people to put down 20% when securing home financing. That it enough time-standing code have provided many to believe so it nonetheless applies today. Although not, on the introduction of Mortgage Insurance coverage (MI) businesses, that is no longer happening. MI people deal with a number of the risk getting a fee, allowing you to put down lower than 20% adding a mortgage premium.

The more you devote down, the reduced their mortgage insurance rates payment could be. Specific software, such as for example jumbo money, do not require home loan insurance policies despite below 20% down. Now, advance payment criteria can differ extensively, starting from 0%, step 3%, step three.5%, or 5%, and growing after that. A down payment out-of 10% or fifteen% might be finest, but getting off 20% will result in a minimal monthly payment because the a share away from your loan count.

Do not forget concerning your settlement costs! Whenever closure the mortgage, you will need to provide their down-payment including any settlement costs which aren’t included in owner.

Brand new underwriter exactly who critiques the loan application has to prove numerous trick elements, mostly ensuring that you have the ability to repay the loan. To do this, they are going to determine the borrowing, money, employment, and you can assets.

Attempt to bring papers you to definitely confirms your earnings, like W-2 variations, tax statements, and you may shell out stubs, as well as documentation of property, such bank statements or other asset statements. For almost all applicants, the product quality set of data files comes with: W-2s, shell out stubs, lender statements, and you may a driver’s license. Extra paperwork may be needed occasionally, but it record talks about the necessities for many of us.