Purchase another vehicle during H1B otherwise L1 performs visas inside the Us. Effortless mortgage out-of borrowing from the bank connection into the reasonable-interest Annual percentage rate yields credit score. To invest in is superior to rental.

H1B or L charge is a-work charge and certainly will getting prolonged indefinitely by the workplace. You are semi-long lasting in the us in the same way that you can remain and you may work until the visa expansion is actually denied.

If you’re able to carry out versus an automobile, which often is not necessarily the instance in the usa, it is best to wait a little for on 4-5 days and create good credit score. Good credit rating makes it possible to get an auto loan at the a lower life expectancy interest rate that’s often called Annual percentage rate within the the united states.

- High repairs prices and you may

- Non-reliability

- Mortgage Apr is highest toward used automobiles

- The insurance premium was high

Just remember that , Car insurance in the usa is recharged towards each day basis and certainly will prices regarding $40 for just liability in order to up-so you can $two hundred to have full visibility to have beginners into U . s ..

Get This new otherwise Car or truck?

To buy a different or dated car decision varies by the person to individual however in my estimation, it is always good for purchase a new one in case the sit are going to be longer than 13 days.

Extremely create almost always advise you to go for an excellent made use of automobile inside budget of about USD 4-5K and you can save money. The primary reason behind this is exactly No credit’ records.

Prominent made use of vehicles for all over the world students, brand new H1B, L specialists in america about finances away from 4k so you can 6k having up to 80k miles and 8-year-old design:

- Nissan Sentra

- Toyota Corolla

- Honda Civic

I would suggest that you get a separate automobile. You can yes rating an auto loan and this as well inside one hour with no credit rating.

If you want to buy a used car, choose merely greatest 3 legitimate labels Toyota, Honda and you will Nissan because they keep the selling worth.

Borrowing Relationship against National Banks

You could deal with credit denials regarding traditional national banking companies such as for example Bank From America’ otherwise Chase’. They generally do not reveal to you auto loans getting period a great deal more than simply their H1B Visa’s validity either.

My personal tip will be to get in touch with local Credit Unions’ since they’re versatile within their lending formula. He is nothing but brief creditors that are significantly more county-situated than the federal sector.

- Lowest Apr (interest rate) than just Bank

- Smaller Running

I am aware a lot of people exactly who had a great 5-seasons car loan financed off Electronic Borrowing Partnership for the MA inside one hour and this also which have an enthusiastic H1B visa authenticity off simply three years.

DCU also reduces your Apr rate once 3 months away from loan if you were paying punctually in place of fault. I have seen an automated decrease in 0.25% inside the Annual percentage rate.

Equivalent credit Partnership financial institutions work in for every single state eg Ca possess CCU and you can Texans Borrowing from the bank Relationship having Colorado people. Create choose one out of your state.

Car Brand Loans Product sales

Honda, Toyota, and you can Nissan certainly are the favourite labels due to their a selling well worth, engine precision and better distance. Noting the newest high demand due to their household members vehicle, these businesses have come 0% Apr (zero per cent attract) car loan also provides when you get money from their very own sibling enterprises.

Rent compared to Purchase

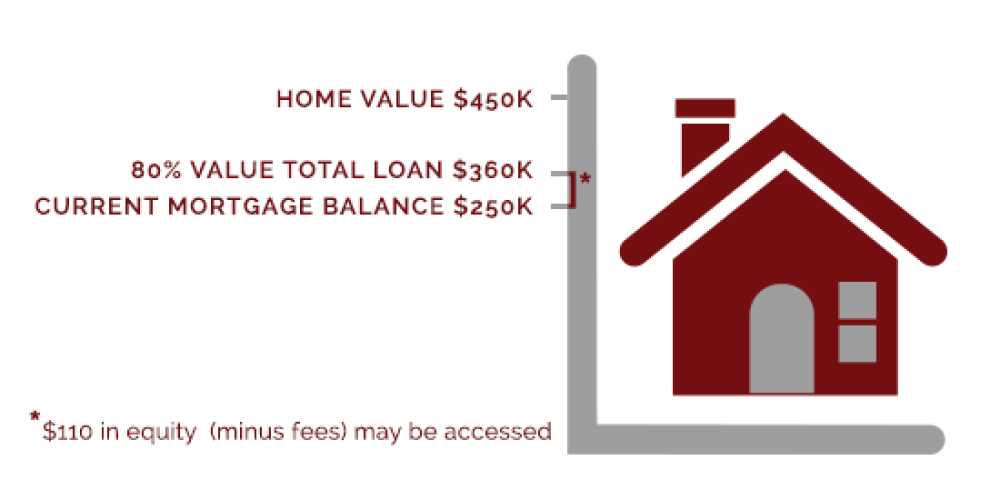

We strongly recommend buying the vehicle even although you need explore lender loans than just rental. If you are not an expert in the transactions otherwise dont understand the leasing procedures, might always pay much more for the auto in the a good rent than simply to purchase.

If you try to speak with the auto financing son at the brand new provider, they are going to mistake you that have book jargons for example:

The brand new sales person are often sell your a rental offer of the exhibiting lower monthly payments than the financing, however,, elizabeth vehicle after the fresh new lease than finance.

While not used to the united states, your credit score was no. Extremely Borrowing Unions manage nonetheless share with you an auto loan in order to you however, possibly which have a top interest otherwise a great guarantor trademark.

You should buy low Annual percentage rate toward car loan nevertheless create often be more than a special car due to the fact bank’s imagine which used vehicles features a lot more likelihood of deteriorating.

Should your used-car was beyond your brand assurance several months out of normal three-years, up coming, expect the Apr becoming easily step one% more than regular.

An authorized tag for the an effective used-car are an advertising secret. An effective Honda dealer promoting an authorized made use of Honda vehicles have a tendency to effortlessly mark-up the price by USD $500-1k to add you to definitely Certified’ level.

The latest broker would only see the auto plus don’t give any additional assurance almost every other after that what exactly is provided on the another auto by the manufacturers.. They will push one get a lengthy warranty anyway.

It is your decision to invest a top superior getting authoritative cars or otherwise not. Really don’t select any extra worthy of cashadvancecompass.com covid-19 personal loan online apply individually.